Multicast Network Solution for the Trading Industry

Business Challenge

Based on the current development of the financial market and the upgrading of various exchange systems, higher requirements have been put forward for the market transmission of the trading network, which is embodied in:

-

System upgrade

-

Deep quotation

-

Release of declaration flow control

- Development of other new futures, options and other businesses

In this regard, in order to better adapt to changes in the market, ECCOM proposed a multicast network solution for the trading industry.

Solution Description

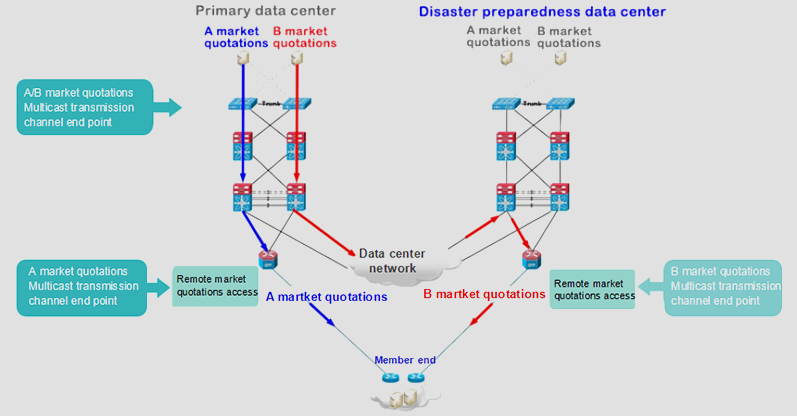

According to the market network framework plan, the multicast border needs to be isolated by security control and the security policy principle of “border strong control” is implemented. The details are as follows:

-

Isolation of multicast domains

Priority is given to using PIM passive mode to prohibit members from establishing multicast neighbors with exchanges; Sparse mode and PIM neighbor filtering are used for some members who drop static push multicast packets without receiving PIM hello packets; Consider the member as the market receiver and push the multicast market statically at the exchange boundary.

-

Protection of market sources and security filtering of illegal multicast traffic

Use ZBF or ACL to isolate the member from actively initiating abnormal traffic to the exchange; ACL is used to isolate members from initiating illegal multicast traffic and IGMPjoin traffic to the multicast transmission channel of the exchange.

Solution Benefit

-

The establishment of an independent market network eliminates the interference of orders and market flow, improves network capacity, supports diversification of trading varieties, better supports future in-depth market and increases the frequency of market release, and meets the needs of high-frequency trading users.

-

The broadcast protocol is changed from unicast to multicast. The international leading exchange's quotation system generally adopts this efficient transmission method, which greatly reduces the bandwidth utilization of quotation data and improves the network capacity and data throughput capacity. The multicast protocol uses PIM SSM mode, which is not only simple to deploy and maintain, but also more secure for the receiving mode of the designated multicast source.

-

Deploying low-latency exchange technology to reduce the transmission delay of the market in the data center, enhance the competitiveness of the exchange industry, and attract more high-frequency trading users. The quotation area also adopts the current fat tree structure popular in the data center. Compared with the previous structure, the vertical traffic passes through the lowest level, effectively reducing the transmission delay of the quotation.

- Providing a unified and standardized multicast network architecture for the member side of the receiving end to reduce the difficulty and risk of member implementation.

Contact Us

Questions about which solutions are right for your organization? We can help!

REQUEST DEMO